A lease agreement, also called a rental agreement, is a legal contract made between someone who owns and/or manages a property such as an apartment or house, and the person or people who rent it. In exchange for rent paid in monthly, weekly, or other consistent increments, the tenants can use the property to their likes, so long it falls in line with the conditions laid out in the lease.

Commercial Lease Agreement – For renting out commercially-zoned real estate to a business.

Lease-to-Own Agreement – Contains a provision that allows the tenant(s) to purchase the property at the end of the lease, if they so choose.

Month-to-Month Rental Agreement – A lease that exists a month at a time, with no long-term commitments. Either party can end the contract by providing a 30-day notice to the other.

Rental Application – Used for screening tenants prior to signing a lease agreement.

Roommate Agreement – For establishing the social rules of a shared apartment or home. For college and university students, download the college (dorm) roommate agreement.

Simple (1 Page) Lease Agreement – A basic rental document that contains the bare minimum necessary for creating a binding landlord-tenant contract.

Standard Residential Lease Agreement (Popular) – The most common type of rental contract. Used for renting out homes, apartments, and other properties to rent-paying tenants.

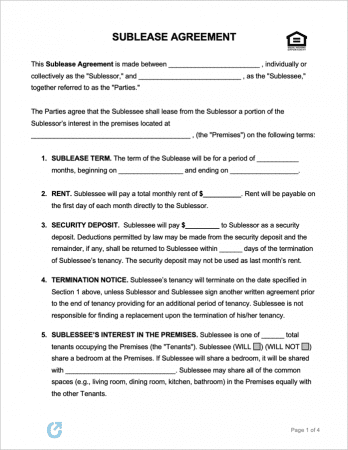

Sublease Agreement – Gives tenants that are locked into a lease a way of re-renting their room, apartment, or home to new a new tenant.

Below is a guide on the leasing process for residential properties. Learn the basics on how to market the property, show the premises to a suitable tenant, obtain their personal information for a credit and background check, and begin collecting rent by signing a lease agreement.

Prior to listing the rental, the landlord should ensure the unit is clean, damage-free (not including standard wear and tear), and compliant with local building codes and regulations. All valuable and/or sentimental possessions should be removed as well.

Next, the landlord will need to determine the property’s rent. This is an important decision, as too high of a rent price can cause the property to remain vacant, whereas too low of a price could result in an overwhelming number of applicants (and lost income on the end of the landlord).

As a general rule, the rent price should:

Once the property is ready for occupants, the landlord can begin advertising the rental. A few popular and time-tested means of finding tenants are as follows:

The majority of apartment-seekers head to online marketplaces where they can browse for rentals that meet their requirements. Filters allow them to search based on rent price, square feet, baths, appliances, and much more. When creating the listing, it’s important the landlord provides as many facts and details about the property as possible. The more characteristics landlords include the more likely they’ll fill the unit’s vacancy.

The classified section of newspapers is a great way to get the word out to potential tenants. While the option is never free, it can help landlords get the word out to those that could be looking for rentals in the future, and that don’t browse rental listing sites. Setting this up is as easy as visiting the newspaper’s advertising page and sending out an email to the party responsible for ads.

Although it’s the simplest option of those provided, placing a sign in the yard or window of the rental property is free exposure that is visible to everyone that passes by. Unlike online marketplaces, a physical sign can inform people of the vacancy that wouldn’t be exposed to it otherwise. This can help spread knowledge of the available rental to those that are in the market for signing a new lease.

If the apartment or home fits the tenant’s expectations and requirements, they will request to sign a lease. It’s at this time that the landlord will request the tenant(s) to complete a rental application. Due to the liability involved with renting, landlords need as much information as possible in order to ensure the tenants moving in to their property are responsible and trustworthy. Landlords should never lease to a tenant that they haven’t properly vetted.

During the screening phase, landlords should obtain the following:

Alongside identifying viable tenants, creating a comprehensive lease agreement is one of the most important tasks landlords face. Leases serve a very important role in the rental process, which is reinforced by the fact that they:

Once an interested tenant has been found and the landlord approves of their rental application, the parties will sit down and discuss the terms and conditions found within the lease. The landlord should go section-by-section through the entire agreement, clarifying any confusing clauses and answering any questions the tenants pose.

If the tenants do not approve of a certain section, they will most likely attempt to negotiate it with the landlord. If the landlord owns a highly-desirable property, they might not negotiate at all. However, if the tenant is exceptional and the tenant’s request isn’t unreasonable, being open to negotiation can be worthwhile.

Important note: It is not the landlord’s responsibility if a tenant skims through the agreement, signs it, and later complains of a condition found within the form. It is the tenant’s responsibility to ensure they agree with all conditions. However, landlords cannot include a section in the agreement that conflicts with state law or the Federal Fair Housing Act.

At this point, the tenant(s) should have read through the entirety of the agreement and discussed any questions or concerns. Once all questions have been resolved, all parties should sign the agreement, either in-person or online.

Having the lease notarized is not required and is rarely done by landlords. While doing so can technically improve the document’s validity, it is generally viewed as non-essential.

With the lease signed, the tenants will be bound to renting the property for the duration stated in the contract. To cover property damage, a missed payment, or other penalties/fees, the landlord should require the tenant(s) to pay a security deposit. The amount is typically equivalent to one (1) months’ rent, although certain states have no limits on the amount that can be charged. In addition to the deposit, the landlord should collect the first month’s rent.

After receiving all deposits in full, the landlord should complete a condition checklist with the tenants. This is a form used for recording any damage/missing items within the rental property. Once the checklist has been completed and all initial payments have been received, the landlord should give the tenant(s) the keys and allow them to move into the property, completing the rental process.

The following are each state’s property management laws.

| STATE | LAWS |

| Alabama | §§ 35-9A-101 to 35-9A-603 |

| Alaska | §§ 34.03.010 to 34.03.380 |

| Arizona | §§ 33-1301 to 33-1381; 33-301 to 33-381 |

| Arkansas | §§18-16-101 to 18-16-409 |

| California | CA Tenants (Guide to Rights & Responsibilities) |

| Colorado | §§ 38-12-101 to 38-12-302 |

| Connecticut | §§ 47-a-1 to 47-a-20f |

| Delaware | §§ 5101 to 5907 (Part 3) |

| Florida | §§ 83.40 to 83.683 |

| Georgia | §§ 44-7-1 to 44-7-81 |

| Hawaii | §§ 521-1 to 521-82 |

| Idaho | §§ 6-301 to 6-324 |

| Illinois | 765 ILCS 705 |

| Indiana | §§ 33-31 |

| Iowa | §§ 562A.1 to 562A.37 |

| Kansas | §§ 58-2501 – 58-2573 |

| Kentucky | KRS Ch. 383 |

| Louisiana | §§ 3251 – 3261 |

| Maine | §§ 6001 – 6017 |

| Maryland | §§ 8-101 to 8-812 |

| Massachusetts | Ch. 186, §§ 1A to 29 & Ch. 186a, §§ 1 to 6 |

| Michigan | §§ 554.601 to 554.616 |

| Minnesota | §§ 504B.001 to 504B.471 |

| Mississippi | §§ 89-7-1 to 89-7-125 |

| Missouri | §§ 441.005 to 441.920 |

| Montana | Title 70, Chapter 24 |

| Nebraska | §§ 76-1401 to 76-1449 |

| Nevada | Chapter 118A |

| New Hampshire | §§ 540:1 to 540:30 |

| New Jersey | §§ 46:8-1 to 46:8-50 |

| New Mexico | §§ 47-8-1 to 47-8-52 |

| New York | §§ 220 to 238 |

| North Carolina | §§ 42-1 to 42-76 |

| North Dakota | §§ 47-16-01 to 47-16-42 |

| Ohio | §§ 5321.01 5321.19 |

| Oklahoma | Title 41 |

| Oregon | §§ 90.100 to 90.875 |

| Pennsylvania | §§ 250.101 to 250.602 |

| Rhode Island | §§ 34-18-1 to 34-18-57 |

| South Carolina | §§ 27-40-10 to 27-40-940 |

| South Dakota | §§ 43-32-1 to 43-32-32 |

| Tennessee | §§ 66-28-101 to 66-28-521 |

| Texas | §§ 92.001 to 92.354 |

| Utah | Title 57 Ch. 1 to 29 |

| Vermont | §§ 4451 to 4475 |

| Virginia | §§ 55-217 to 55-248 |

| Washington | §§ 59.04 to 59.30 |

| West Virginia | Article 6 & Article 6A |

| Wisconsin | §§ 704.01 to 704.95 |

| Wyoming | §§ 1-21-1201 to 1-21-1211 |

A security deposit is a payment made by the tenant at the start of the lease to cover property damage, missed payments, and other issues. If the tenant takes care of the property and doesn’t miss any payments, the landlord will return the deposit in full to the tenant. The table below outlines the maximum amount ($) that can be collected for a security deposit in each state.

| STATE | MAXIMUM DEPOSIT |

| Alabama | One (1) month’s rent (with exceptions) |

| Alaska | Two (2) month’s rent (with exceptions) |

| Arizona | One and a half (1.5) month’s rent |

| Arkansas | Two (2) month’s rent |

| California | Two (2) month’s rent |

| Colorado | No limit |

| Connecticut | Two (2) month’s rent (with exceptions) |

| Delaware | No limit (for the first rental year) |

| Florida | No limit |

| Georgia | No limit |

| Hawaii | One (1) month’s rent (with exceptions) |

| Idaho | No limit |

| Illinois | No limit |

| Indiana | No limit |

| Iowa | Two (2) month’s rent |

| Kansas | One (1) month’s rent (with exceptions) |

| Kentucky | No limit |

| Louisiana | No limit |

| Maine | Two (2) month’s rent |

| Maryland | Two (2) month’s rent |

| Massachusetts | One (1) month’s rent |

| Michigan | One (1) and a half month’s rent |

| Minnesota | No limit |

| Mississippi | No limit |

| Missouri | Two (2) month’s rent |

| Montana | No limit |

| Nebraska | One (1) month’s rent (w/ exceptions) |

| Nevada | Three (3) month’s rent |

| New Hampshire | One (1) month’s rent or $100 (w/ exceptions) |

| New Jersey | One and a half month’s rent (1.5) (contains exceptions) |

| New Mexico | One (1) month’s rent |

| New York | One (1) month’s rent |

| North Carolina | One (1) and a half month’s rent (with exceptions) |

| North Dakota | One (1) month’s rent (with exceptions) |

| Ohio | No limit |

| Oklahoma | No limit |

| Oregon | No limit |

| Pennsylvania | Two (2) month’s rent (with exceptions) |

| Rhode Island | One (1) month’s rent |

| South Carolina | No limit |

| South Dakota | One (1) month’s rent (contains exceptions) |

| Tennessee | No limit |

| Texas | No limit |

| Utah | No limit |

| Vermont | No limit |

| Virginia | Two (2) month’s rent |

| Washington | No limit |

| West Virginia | No limit |

| Wisconsin | No limit |

| Wyoming | No limit |

After the lease has ended, landlords need to return the security deposit (or whatever remains of the deposit) to the tenant(s) within a certain length of time.

| STATE | DEADLINE |

| Alabama | Sixty (60) days after the termination of the tenancy |

| Alaska | Fourteen (14) days if the tenant provides the proper notice (of their vacancy); Thirty (30) days otherwise. |

| Arizona | Fourteen (14) days after the termination of the lease (not including weekends & holidays) |

| Arkansas | Sixty (60) days after the termination of the lease |

| California | Twenty-one (21) days after the tenant(s) move out, or within sixty (60) days after the termination of a fixed-term lease |

| Colorado | One (1) month after the termination of the lease, or the tenant moves-out of the rental |

| Connecticut | Upon receiving the tenant’s mailing address, fifteen (15) days; upon the termination of the tenancy, thirty (30) days (whichever is less) |

| Delaware | Twenty (20) days after the termination of the lease |

| Florida | If no deductions, fifteen (15) days. If deductions are made the deposit, thirty (30) days |

| Georgia | Thirty (30) days after the tenant moves out of the rental |

| Hawaii | Fourteen (14) days after the lease officially ends |

| Idaho | Within thirty (30) days if established by the lease; twenty-one (21) days if not |

| Illinois | If the landlord makes deductions from the deposit, thirty (30) days; if no deductions, forty-five (45) days |

| Indiana | Forty-five (45) days after the termination of the lease |

| Iowa | Thirty (30) days after the tenant(s) have moved out and provided the landlord with a forwarding address |

| Kansas | Fourteen (14) days after the tenant requests the deposit; thirty (30) days otherwise |

| Kentucky | Landlords must send a notification stating the tenant’s refund owed. If no response is heard within sixty (60) days, they can keep the deposit |

| Louisiana | One (1) month after the end of the lease |

| Maine | Twenty-one (21) days for periodic leases; thirty (30) days for fixed-term leases |

| Maryland | Forty-five (45) days after the end of the lease (with interest) |

| Massachusetts | Thirty (30) days after the termination of the rental contract |

| Michigan | Thirty (30) days after the official end of the lease |

| Minnesota | Three (3) weeks after the end-date of the lease; five (5) days if the tenant was forced. to leave the rental due to no fault of their own |

| Mississippi | Forty-five (45) days after the lease is officially terminated |

| Missouri | Thirty (30) days after the termination of the tenancy |

| Montana | Ten (10) days if no deductions and unpaid debt; thirty (30) days otherwise |

| Nebraska | Fourteen (14) days after the termination of the lease |

| Nevada | Thirty (30) days within the termination of the rental agreement |

| New Hampshire | Thirty (30) after the lease is terminated |

| New Jersey | Thirty (30) days after the rental contract is terminated |

| New Mexico | Thirty (30) days starting from the lease’s end |

| New York | Fourteen (14) days after the tenant(s) have moved out of the premises |

| North Carolina | If no deductions, thirty (30) days. If deductions, sixty (60) days. |

| North Dakota | Thirty (30) days within the termination of the lease |

| Ohio | Thirty (30) days after the lease is terminated and the landlord takes possession of the rental |

| Oklahoma | Forty-five (45) days after 1) the lease ends, 2) the tenant(s) have moved out, and 3) they have requested their deposit |

| Oregon | Thirty-one (31) days after the lease ends and the tenant(s) have moved out |

| Pennsylvania | Thirty (30) days after the termination of the lease, or after the tenant(s) move out (whichever comes first) |

| Rhode Island | Twenty (20) days after the tenant provides the landlord with a new forwarding address, they move-out, or the lease ends (whatever comes last) |

| South Carolina | Thirty (30) days after the tenants move out, provide the landlord with a new address, and request the deposit |

| South Dakota | Two (2) weeks. Must provide a list of any deductions (if requested by tenants) within forty-five (45) days after the termination of the lease |

| Tennessee | Thirty (30) days after the tenant(s) have moved out, or seven (7) days after new tenant(s) move in |

| Texas | Thirty (30) days after the tenant(s) leave the rental |

| Utah | Thirty (30) days starting from the date the tenant(s) move out |

| Vermont | Fourteen (14) days after receiving notice or discovering the property was vacated; sixty (60) days for non-permanent rentals and seasonal tenancies |

| Virginia | Forty-five (45) days after the termination of the lease |

| Washington | Twenty-one (21) days after the tenant(s) move out of the rental |

| West Virginia | Sixty (60) days after the termination of the lease; forty-five (45) days if the rental is re-leased |

| Wisconsin | Twenty-one (21) days after the tenants have moved out of the rental |

| Wyoming | Thirty (30) days after the termination of the lease or fifteen (15) days after the landlord receives the tenant’s forwarding address. If damage to the rental, landlords can have an additional thirty (30) days |

Prior to entering a property for inspection, repairs, showings, and other non-emergency reasons, a notice might have to be provided. The following table provides each state’s notice requirements regarding entering a rental unit.

| STATE | REQ. NOTICE TO ENTER |

| Alabama | Two (2) days (§ 35-9A-303(c)) |

| Alaska | Twenty-four (24) hours (§ 34.03.140(c)) |

| Arizona | Two (2) days (§ 33-1343(d)) |

| Arkansas | N/A |

| California | Twenty-four (24) hours (§ 1954(2)) |

| Colorado | N/A |

| Connecticut | Adequate notice (§ 830-47a-16(d)) |

| Delaware | Two (2) days (§ 5509(b)) |

| Florida | Twelve (12) hours (§ 83.53(2)) |

| Georgia | N/A |

| Hawaii | Two (2) days (§ 521-53(b)) |

| Idaho | N/A |

| Illinois | N/A |

| Indiana | Adequate notice (§ 32-31-5-6(g)) |

| Iowa | Twenty-four (24) hours (§ 562A.19 A(3)) |

| Kansas | Adequate notice (§ 58-2557(a)) |

| Kentucky | Two (2) days (§ 383.615(3)) |

| Louisiana | N/A |

| Maine | Twenty-four (24) hours (§ 6025(2)) |

| Maryland | N/A |

| Massachusetts | Adequate notice (§ 15B(1)(a)) |

| Michigan | N/A |

| Minnesota | Adequate notice (§ 504B.211(Subd 2)) |

| Mississippi | N/A |

| Missouri | N/A |

| Montana | Twenty-four (24) hours (§ 70-24-312(2)) |

| Nebraska | One (1) day (§ 76-1423(3)) |

| Nevada | Twenty-four (24) hours (§ 118A.330(3)) |

| New Hampshire | Adequate notice (§ 540-A:3(V)) |

| New Jersey | One (1) day (§ 5:10-5.1(c)) |

| New Mexico | Twenty-four (24) hours (§ 47-8-24(1)) |

| New York | N/A |

| North Carolina | N/A |

| North Dakota | Adequate notice (§ 47-16-07.3(2)) |

| Ohio | Twenty-four (24) hours (§ 5321.04(8)) |

| Oklahoma | One (1) day (§ 41-128(C)) |

| Oregon | Twenty-four (24) hours (§ 90.322(b)) |

| Pennsylvania | N/A |

| Rhode Island | Two (2) days (§ 34-18-26(c)) |

| South Carolina | Twenty-four (24) hours (§ 27-40-530(c)) |

| South Dakota | Twenty-four (24) hours (§ 43-32-32) |

| Tennessee | Twenty-four (24) hours (§ 66-28-403(e)(5)) |

| Texas | N/A |

| Utah | Twenty-four (24) hours (§ 57-22-4(2)) |

| Vermont | Forty-eight (48) hours (§ 4460(b)) |

| Virginia | Twenty-four (24) hours (§ 55-248.18(A)) |

| Washington | Two (2) days (§ 59.18.150(6)) |

| West Virginia | N/A |

| Wisconsin | Adequate notice (§ 704.05(2)) |

| Wyoming | N/A |

Yes, any person can electronically or digitally sign a lease agreement. Created in October 2000, the E-Sign Act made it possible for individuals to electronically sign documents instead of entering their signatures by hand. Landlords seeking to collect legitimate, digitally secure tenant signatures can use eSign.com.

If a tenant breaks the lease, the landlord should take action immediately. First, they must review the terms listed in the mutually signed lease agreement. This information will advise the tenant of the mandatory steps to take should the tenant stop paying their rent. In most cases, this process includes the following:

Important Exceptions:

In some cases, a tenant can lawfully vacate a rental. They are the following:

Yes. Once signed by the landlord and tenant(s), it binds them to the conditions included, so long the rules and obligations comply with state and federal laws. While the agreement as a whole is legally binding, it’s important to know that not all of the sections can be enforced by a court of law.

For example, if the rental agreement contains a condition that requires the tenant(s) to keep silent about a part of the building/premises that doesn’t comply with local building codes, the tenant(s) do not have to comply with the condition. Rather, they should first inform the landlord of the issue in writing (following the required notice periods), followed by the local/city housing authority if no response is received.

What about a verbal lease agreement?

Yes. While verbal leases are not recommended , state laws view them as legally binding agreements. However, due to the difficulty of enforcing the conditions and proving what was agreed-upon, they should only be used in situations where the parties have extreme trust in one another (family, for example), or are leasing a property that the landlord will also share (a single room, for instance).

“Lease agreement” and “rental agreement” are terms that are often used interchangeably to refer to a binding agreement over the right to live or work in a residential/commercial property. Although commonly used to mean the same thing, they differ in the term (duration) of their contracts.

Notarization is the process of having a certified third (3rd) party officially verify a signature on a legal document. Generally, lease agreements do not have to be notarized. However, certain states, such as Ohio, require leases longer than three (3) years to be certified by a Notary Public.

Although it’s not required, having a lease be notarized is an additional means of security, ensuring a lease agreement is enforceable in a court of law.

Possibly. From a landlord’s point of view, the answer depends on whether or not their right to terminate is stated in the lease agreement. For a tenant, it also depends on the written lease, but also state law, which can provide the tenant with room for exiting the lease without incurring damages and other costs. In this situation, it’s in the best interest of landlords and tenants to provide notice to the other party of their intent to terminate the lease as soon as possible and try to come to an agreement on their own without involving litigation.